As mentioned in our February update, we added two new positions in February. These were in:

Integrated Research (ASX:IRI); and

EVZ Limited (ASX:EVZ).

Both positions are small and definitely fall into the “value” category. Despite that similarity, the two companies operate in very different industries. Integrated Research is a software company that has products across Communications, IT Infrastructure, and Payments. EVZ is an engineering services company that operates primarily across the energy space. We look into both below.

Integrated Research

With Integrated Research, the best place to start is by looking at the share price history. This company has gone from disaster to market darling, and back again.

Source: Google

In the early days, the company used to charge a one off licence fee for its products. The rally from c. 2011 through to 2018 was largely driven by a new subscription revenue model. We can see this growth in revenue below.

Source: Company Filings

Revenue peaked in 2019 and fell sharply during the Covid periods. There is an important reason behind this fall which I will touch on shortly.

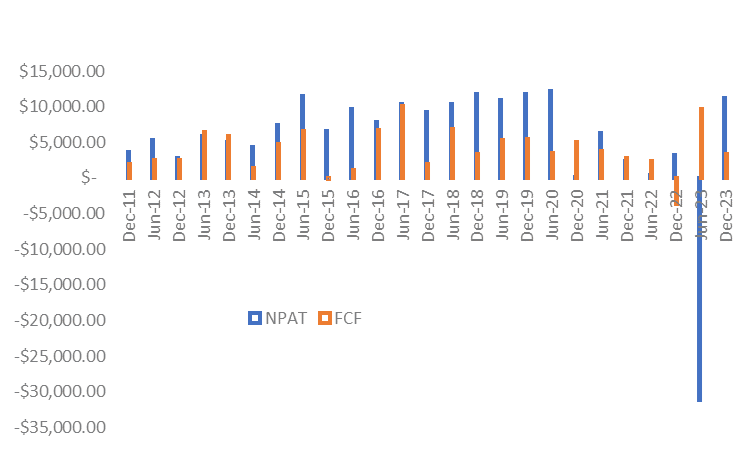

Profit followed the trajectory of revenue, increasing from 2011 to 2019 before falling significantly. You may note that Free Cash Flow lagged NPAT in most periods. The company historically capitalised a significant portion of their Research and Development. This capitalisation led to a significant writedown in FY23, that can be seen in the $31m loss below. The company has since moved to a fully expensed R&D model and has completely written down its intangibles.

Source: Company Filings, Author’s calculations

As mentioned above, revenues and profits fall sharply during Covid. Integrated Research has many products, but they are all built off a platform called Prognosis. Prognosis allows users to look at an IT network and when it is down, they are able to identify where the fault lies. Across large networks, this is an important tool. However, Covid brought about changes in how we work. The most important change for Integrated Research was an acceleration in the adoption of Cloud technology and the rise of the communication tools such as Zoom and Microsoft Teams. The chart below shows the revenue across the various products Integrated Research offers. The major fall has come from Collaborate, which is the communications product and is the most effected. Whilst the company has moved to integrate itself with Cisco’s cloud offering, the new generation of products meant a loss in business.

Source: Company Filings

Over the last 18 months we have seen some stabilisation in the revenue base for Collaborate, however the headwinds are likely to continue.

On the flip side, we have seen a bounce in the Infrastructure and Transactions revenues. The Transactions revenues have the greatest potential to grow over the medium term as different payment providers grow and / or come into existence. Having said that, our growth expectations are minimal. We bought the shares when it had a market cap of $59m (currently $69m) and $21.5m of cash on the balance sheet. That gives an Enterprise Value of $37.5m. In the last 12 months, the company has generated $13.1m of Free Cash Flow, putting it on a multiple of 2.9x. The reason for this improvement in cash flow is cost cutting from management. This lower cost base is needed in order to maintain the business as a going concern because of the fall in Collaborate revenues. Overall, we aren’t expecting much (if any) growth but due to the valuation we believe we have limited downside. The company won new contracts in the Infrastructure and Transaction segments in the last half, if that continues there could be upside. However, until those come through, it will remain a small position for us.

The key risk in buying the shares is that we may be underestimating the future decline in Collaborate and / or the ability for the other products to grow and offset that decline.

EVZ Limited

EVZ is a low margin engineering services business that operates across the energy and resources, as well as the building sectors. It’s not an overly exciting company but it has had a solid last two years. Revenue has grown.

Source: Company Filings

In turn Free Cash Flow has been strong (with the exception of June 2023).

Source: Company Filings, Author’s calculations

This has meant cash has built up on the balance sheet.

Source: Company Filings, Author’s calculations

This brings us to valuation. The current market cap is $19.4m and the company has net cash of $10.4m. Therefore, we are paying $9m for a business that has generated NPAT of $1.8m over the last 12 months (5x) and $4.3m in Free Cash Flow over the last 2 years.

The one negative from the result is the pipeline / backlog has dropped, however the company did state in the half year results that they expect that to grow as the currently the preferred provider on a number of contract opportunities.

With the cash on the balance sheet, we feel there is limited downside at this stage. The company is potentially leveraged to the shift to renewable energy and that could provide some upside if they win work and price it correctly. As a result, we feel the balance of risks is to the upside with the caveat that we may be wrong.

Having cash on the balance sheet does derisk both of these investments in the short term, but with small caps you always have to be aware that management teams love spending it and, in some instances, you just have to trust them not to blow it. Both Integrated Research and EVZ have indicated that they are looking at potential acquisitions, when and if these occur we will review them on that merits before making any decisions.

As mentioned as the start, both of these are small positions as they are turnaround stories. In both cases, we would want to see further evidence of positive earnings momentum before making them more meaningful, particularly in the case of Integrated Research which still faces some structural headwinds.

Just a friendly reminder that none of the above is investment advice, it is factual commentary on a portfolio run by the author.

I'm looking at IRI as well. Do you know the reason for the massive receivables balance on the BS? It has started to comes down but it's highly unusual for a tech company.