A little bit late this month with the report. There is a lot happening in markets and in life. The main reason for the delay is something that would have led to the end of this Substack but after a 3 month process that didn’t eventuate. With that out of the way, onto reporting season.

The portfolio for the month was up 2.51% against the All Ords Accumulation at 1.17%. Since inception, the portfolio is up 49.4% against the All Ords Accumulation at 15.5%.

Before looking at the companies that reported, the best performing stock in the portfolio last month was Gentrack (+20.8%). We are now up 193% on our purchase in March last year. Gentrack did not report during the month, but they did announce a $12m investment in a company called Amber. Amber is a technology company that gives consumers access to real time energy prices and helps them automate the charging of EV and home batteries. The reality of this purchase is that Amber is most likely loss making, needs venture capital and therefore is not likely to draw much attention from Gentrack investors until they see more detail. The rise in the share price is more likely due to a lack of sellers in a low volume stock combined with a general rise in growth stocks due to falling interest rate expectations.

Moving on to the companies that did report and usually the easiest way to examine the results is to look at the market move. Strong results will typically be rewarded whilst disappointing results punished. On that front, we saw the following moves:

SRG Global +12.3%

Austco Healthcare -5.3%

Close the Loop -6.3%

Environmental Group -7.4%

Overall, it is fair to say that SRG exceeded expectations whilst the other three disappointed. We will have a look at these below. We also added two new positions during the month, we will touch on these in a later post.

SRG Global (ASX:SRG)

The SRG share price went up; however, it is probably fair to say that the result was in line with our expectations. Revenue was up mainly on the back of the ALS acquisition completed last year.

Source: Company filings

Profits followed suit and the most pleasing thing from the result was the bounce back in Free Cash Flow after the working capital draw associated with the above mentioned acquisition.

Source: Company filings, author’s calculations

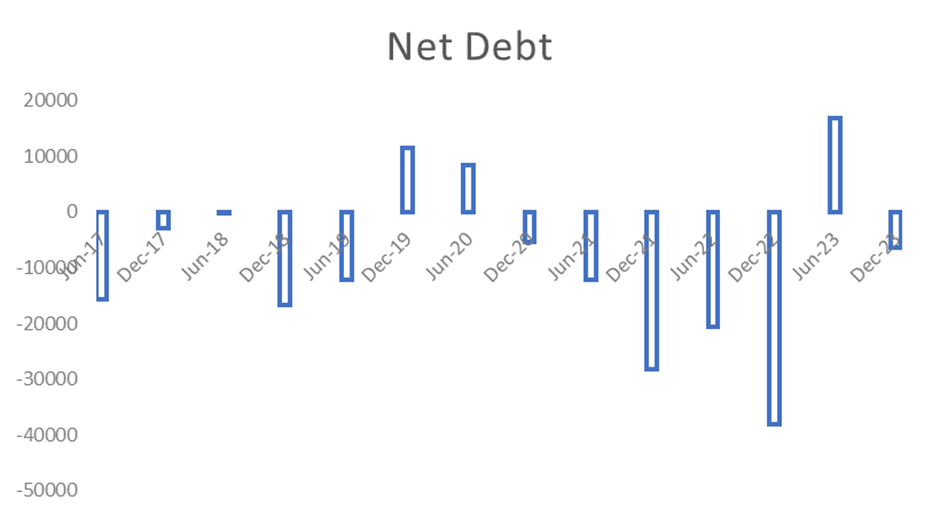

This cash inflow pushed the balance sheet back to net cash after they took on some debt to complete the acquisition.

Source: Company filings, author’s calculations

Guidance was "upgraded”; however, this is a bit misleading. Previous EBITDA guidance was for 20% growth which would bring it to $96m, so the midpoint of the new range implies a 1.6% upgrade.

Source: Company filings

Overall, it was a solid result, the shares were trading on a low multiple and have seen a relief rally. We continue to hold with a positive outlook, strong cashflow and a decent dividend yield.

Austco Healthcare (ASX:AHC)

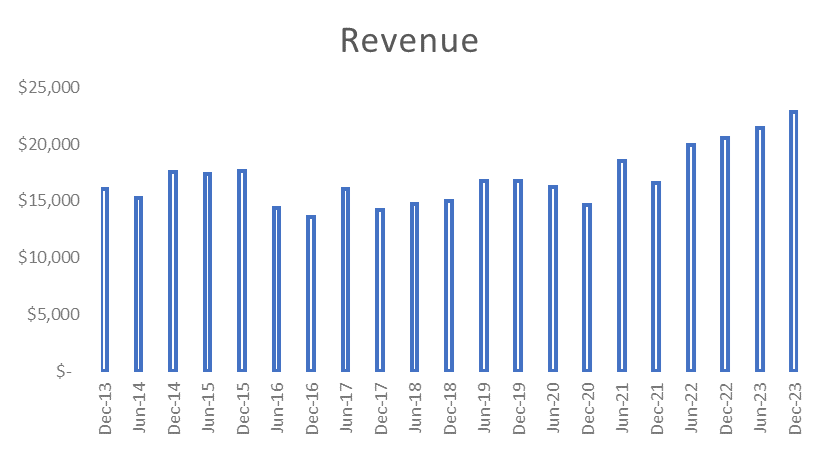

It was a familiar result from Austco, with revenue growth but a lack of associated profit growth. The company continues to invest ahead of (hopefully) continued growth in that revenue base.

Source: Company filings

Profit was down on the prior corresponding period but up on the last half.

Source: Company filings, author’s calculations

The positive news is that the company has guided to cost growth moderating, meaning profit growth should start to come through.

Source: Company filings

And revenue growth is set to continue with open orders hitting a new high.

Source: Company filings

Growth is also set to come via acquisition, with the company announcing the acquisition of a Queensland based Healthcare company, Amentco. Similar to the previous acquisition of Teknocorp, Amentco is an existing Austco reseller and aligns with the strategy of increasing Austco’s direct sales channel. Amentco is forecast to achieve $13m in revenue and $3m in FY24.

So revenue growth looks positive, but the lack of profit growth is starting to become a concern despite the assurances from the company that it is coming. Aside from that, there has been one other concerning element from the recent results. This concern is that they continue to capitalise some software development. That in turn potentially means near term profits are overstated.

Source: Company filings

It is particularly concerning because software revenues only grew $400k over the last 12 months, against that $886k capitalisation. If that trend continues, we could see the write down of the intangibles that are building on the balance sheet at some stage in the future. We would want to see higher growth in software revenues to avoid this outcome.

Overall, there are some positives and minuses from the result. We sold part of our position to lock in some gains, the main reason behind this is the fact the company’s free cash flow has been negative over the last 12 months after taking into account the software capitalisation. This is against a market cap now of $58m compared to the c. $30m we started buying at. The outlook is still positive in terms of revenue growth, but the company really needs the profit growth to come through now.

Environment Group (ASX:EGL)

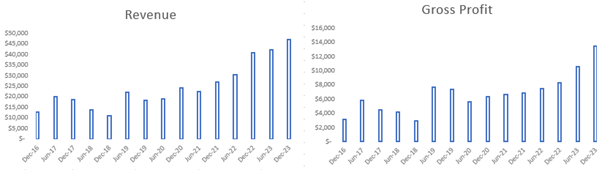

There wasn’t much wrong with the result from Environmental Group in our opinion. Revenue and Gross Profit continue to grow.

Source: Company filings

This growth is largely driven by the Airtight acquisition in April 2023. The revenue growth flowed through to higher NPAT.

Source: Company filings, author’s calculations

In addition, the company upgraded guidance from 30% EBITDA growth to 45%. Despite the upgrade, the shares fell. The main reason in our opinion is the price. The shares had rallied into the result and annualising the first half earnings gives NPAT of $4m and puts it on a multiple of 23x even after the subsequent fall. We are expecting growth in that earnings base over the next 18 months and do expect the company to grow into the valuation, however it was clearly overvalued in the short term prior to the result. The balance sheet remains in good shape, and acquisitions could also be a factor in the short to medium term.

Close the Loop (ASX:CLG)

The market reaction from Close the Loop surprised us. We thought it was a strong result with a guidance upgrade, and despite this the shares fell 6.3% and have continued to fall in March.

Revenue and Gross Profit rose driven by the acquisition of ISP Tek Services.

Source: Company filings

NPAT was up marginally, however it is important to note that Free Cash Flow was significantly ahead of it.

Source: Company filings, author’s calculations

They also upgraded EBITDA guidance from “at least $43m” to between “$44m and $46m”. However, as many people point out, EBITDA is not the best metric for this business as depreciation is a true expense here. On the other side, in this instance I would argue NPAT isn’t the best metric either. Due to the intangibles associated with the ISP acquisition, NPATA is the better metric and should align more closely with Free Cash Flow.

The company has called this Underlying NPAT in the table below.

Source: Company filings

For the half, it doesn’t quite align with FCF, which came in $9.1m but over time we would expect that to be more aligned than NPAT. If we double the first half, we come up with $18.2m FCF and $26.5m NPATA. Looking at the current share price, this gives us multiples of 8.7x FCF and 6x NPATA, hardly expensive at all.

A slowdown in the packaging division could be a reason behind the fall, or the lack of a dividend. On the positive side, the ISP acquisition has exceeded expectations and the positive cashflow from the half reduced Net Debt and has led to a position where the company has indicated it will consider buybacks, dividends, and further acquisitions in the near future. We have added to our position post the result.

Just a friendly reminder that none of the above is investment advice, it is factual commentary on a portfolio run by the author.