Gentrack – Checking in on the turnaround

I first invested in Gentrack (GTK on the ASX and NZX) back in 2015. The company listed in 2014 and then proceeded to commit the cardinal sin of downgrading just barely 6 weeks after listing. This led to the stock price spending almost two years in purgatory as the company had to regain the trust of the market.

The company then went about its business quietly and grew their earnings organically through to March 2017. The share price followed suit. Things then started to change and an acquisition spree began.

They acquired the following:

Junifer Systems for $74.6m in March 2017 with forecasted revenue and profit at the time of £10.8m and £4.2m respectively. The acquisition was funded by debt and the issue of equity at between $3.65 and $3.72 per share.

79.81% of Blip Systems for $8.4m in April 2017 with an earnout for the remainder.

75% of CA Plus for $11.4m in April 2017 with an earnout for the remainder.

Evolve Analytics for $44.2m in June 2018 with forecasted revenue of and profit at the time of £3.1m and £1.8m respectively. This was funded via debt although one month later the company raised $90m to pay down debt and “support future acquisition and growth opportunities.”

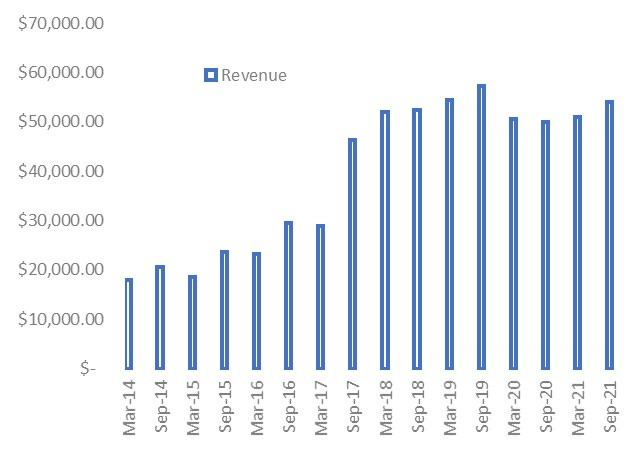

Over a period of 15 months, the company made 4 acquisitions at a cost of $138.6m (not including earnouts). Junifer and Evolve were about expanding the UK presence and adding an analytics capability whilst Blip and CA Plus were done to expand the Airport offering. In total the acquisitions increased revenue by 91% on a rolling 12-month basis ($58.4m in the 12 months to March 2017 to $111.7m in the 12 months to September 2019).

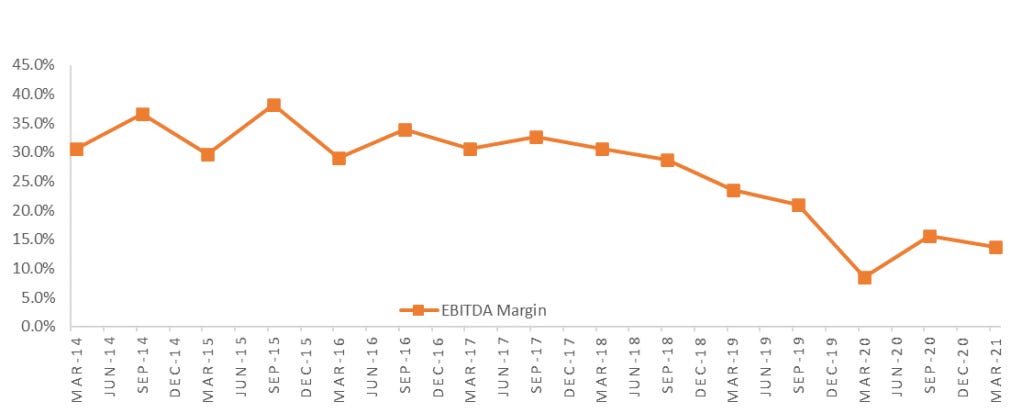

However, earnings didn’t followed suit, looking at EBITDA we can see that things started to go wrong in the September 2018 half or the 2nd half of the financial year. I’ve used EBITDA here but will move on to proper earnings and cashflow later.

Margins also tell the story. They initially dropped on the acquisitions being smaller scaled businesses than the core operations but then again dropped further as business performance stalled.

At this point the stock had rerated from a P/E of 16x when I purchased it to over 30x. I took the warning and the opportunity to exit. The question to ask now is whether it is a good time to re-enter the stock. To answer we need to look back at the reasons for the fall in earnings to see whether the issues are terminal or whether they have been resolved.

Going back to September 2018 when the fall began and the headline year on year result looks good. If we drill down, we see top line growth in both Utilities and Airports. Of course, a big part of this was the acquisitions listed above. Due to Junifer Systems and Evolve Analytics, suddenly the UK Utilities market has become the company’s most important with $40.5m of the $85.1m revenue in their Utilities segment coming from the UK. One small line in the outlook section is the warning about what was to come – “Currently there is significant uncertainty for UK energy retailers. Government intervention and price regulation have compounded Brexit concerns. Customers are adopting a cautious approach to new projects in our pipeline.”

Essentially a small company had bought into a foreign market at a poor time and didn’t understand the regulatory environment (might be a read through here for EML Merchants currently…) It's also worth reminding people that the $90m placement mentioned above happened just prior to the September result, and is now starting to look very “well timed.” Signalling theory well at work in this instance.

From there, revenue fell and earnings continued to decline. The balance sheet had accumulated significant intangibles on the back of the acquisitions and returns are needed to justify those carrying values. As profits were falling, so were returns.

Fast forward to March 2018 and the write offs began. They wrote off the entire holding balance of CA Plus. Sales growth had not come as expected and the software was not delivering as a standalone solution. The software was integrated into its existing airport product.

Despite that write off, the weakness in that financial result actually came from the Utilities division and in particular Australia with “no large projects in the half.” In other words, they had a drop in project revenue.

Despite the poor result, the share price held above $5. The impact of CA Plus on future earnings was minimal and investors seemed to be banking on the fall in project revenues being temporary.

Moving on to September 2019, and prior to the release of the full year results we get yet another “red flag”. The company downgraded full year expectations twice, first in July 2019 and then in September 2019. The expectations of EBITDA were downgraded in total from “marginally above $31m” to between $25m and $26m. The company once again blamed the UK with “increased bad and doubtful debt provisions” due to “regulatory imposition of price capping for retailers in January 2019.”

The guidance then given at the 2019 result was for the 2020 results to be “broadly flat”. This guidance lasted all of two months with a downgrade in January. Expectations were more than halved to EBITDA of between $8m and $12m. The impact of bad acquisitions in a market that faced regulatory change combined with a fall in Australian Utility project revenues had caught up with the company. Further write-downs ensued and as can be seen below Free Cash Flow had basically remained flat despite the $138m spent on acquisitions and the significant shareholder dilution.

That downgrade saw the end of the CEO with the Chairman taking on an executive role. A new CFO also came in as the deck chairs were reshuffled. Post the management changes it got even worse with guidance suspended in March.

In March 2020, they wrote off the entire intangible holding of Blip Systems as well as taking a small $1.5m hit on their capitalised software for the UK energy retail.

In September 2020, they took a further $3m write down on capitalised software as well as a $19.3m goodwill hit on their utilities business.

The focus after the management change was cost reduction and that combined with working capital release has seen cash flow hold up reasonably well.

So where is the turnaround? Latest FY21 guidance has revenue growing. Full revenue is set to come in $105m which puts the 2nd half at c. $54m, a 6% increase on the first half. EBITDA is expected to come in at $12m, this puts the 2nd half at $5m, down on the first half. The decrease is due to increased R&D spend with the company moving back to its original policy of fully expensing R&D.

The slight uptick in revenue is the first positive news in a while for the company. It will be interesting to see the composition of revenue when the full year result is released next month. Is this the return of project work? The split in revenue is important, because the other aspect worth highlighting is that the company has grown its recurring revenue over the last three years despite their troubles.

The fall in project revenue is the key driver behind the downgrades and overpaying for that project revenue via acquisition is the key driver behind the asset write downs. As a percentage, non-recurring revenue was 43% in 2017 and this fell to 19% last year. This fall in revenue led to the necessity to cut costs.

One problem for 2022 is that recurring revenue is likely to drop; c. $10m is set to be lost through bankruptcies in the UK as well as a customer migrating to their own internal system. This creates an earnings hole next year that needs to be filled. In fact, based on the current year’s guidance, it wipes out most of their earnings.

Margins have fallen driven by the lower revenue.

This begs the question of whether the project revenue will return. Brexit and COVID have led to uncertainty which has held back capital spend for businesses. The bigger issue though is the UK regulatory environment and the price caps leading to the smaller players going out of business. The number of retail energy suppliers has fallen from 70 to 45 over the last three years and more are expected to fall. Retail price caps combined with inadequate or ineffective hedging has led to the downfall. Whilst Gentrack is losing smaller customers, it does also have 4 of the big 6 signed up. These larger companies should emerge in a better position.

Some stability in the UK market could lead to a return to earnings growth and there is talk of government intervention. At this stage, it is very early days but the drivers of the earnings growth in the 2nd half will be interesting to see.

The company currently has a market cap of $185m and cash on the balance sheet of $22m giving an EV of $163m (cash should also be higher at the full year result). This puts the EV/Sales at 1.55x revenue, well below peers. EV/EBITDA on this year’s earnings is 13.5x which isn’t overly cheap particularly considering the earnings hole next year. With the accounts moving back to fully expensing R&D then capex should be minimal and EBITDA less tax will be a good representation of FCF.

At the company’s strategy day back in June, they put out targets for 2024. Taking the mid-point of those forecasts would place EBITDA at c. $23m and put it on an EV/EBITDA of 7.1x for 2024. Obviously, a lot can happen between now and then, so these forecasts mean very little. It feels like this turnaround is a 2023/2024 story.

Finally, time for some pure speculation. One of Gentrack’s competitors is Hansen Technologies. Hansen was recently subject to a takeover from BGH Capital, however after due diligence BGH walked away. When looking at Hansen’s recent result, the headline numbers look strong (8% growth in revenue, 50% growth in EBITDA and 69% in NPATA). When delving deeper one footnote stands out. That footnote is the Telefonica contract of $21m recognised in FY21 for which the work will happen over three years. This explains the jump in EBITDA and NPATA relative to revenue as the costs of the project will continue. This also means Hansen has an earnings hole of their own to fill next year so there is a good chance will be on the lookout for acquisitions. After all, they have made over 30 acquisitions.

I’m sure Hansen would have looked at Gentrack in the past. Prior to the recent acquisitions, they were just a smaller competitor in Australasia with a small Airport offering. The acquisitions moved them into the UK which could compliment Hansen’s current geographical scope. Of course, Hansen wasn’t interested at $6 with peak earnings but they be may interested at $1.80 if the regulatory environment stabilises and project revenue returns. Hansen currently trades at an EV/Sales of 4x, if they believed they could extract some synergies out of Gentrack then the numbers could work.

Anyway, that is purely unsolicited speculation. Meanwhile, it’s early days for the Gentrack turnaround and there are headwinds persisting in 2022. It is one to keep an eye on though as it works it way through some poorly timed acquisitions. Keep an eye on project revenue this result and guidance for next year will be interesting. There is a small sign of positivity coming from the company, however headwinds remain.