March is typically a quiet month for company news. Reporting season in the US and Australia has passed and hence the focus is typically on Macro factors, and there was plenty of Macro to talk about last month. Equity markets fell in the early part of the month, as banks became the focal point with the collapse of Silicon Valley Bank (SVB) and then the subsequent panic around Credit Suisse. There are some echoes in the market movements of 2008 as the collapse of Bear Sterns led to a selloff followed by a relief rally. However, in the case of SVB, the problems arose due to horrendous liquidity management. I recently wrote the below elsewhere:

“SVB was founded in 1983 but its growth in recent years has exploded, its recent 10K highlighted that its deposit growth in 2021 and 2022 was significant (c. $130 billion in total), and also stated that if that growth was to continue it would need further equity to support its capital ratios. This growth, however, did not continue. The deposits had largely come from the venture capital industry (it serviced half of the VC industry) and the bank couldn’t write loans fast enough to keep up. Therefore, in order to get a return on these funds, the bank started buying long term bonds. With the FOMC hiking aggressively, these bonds started falling in value (when rates go up, bond values fall). This would all be okay if the deposits matched the 30 year bonds they were buying, however deposits can leave at any time. So, with the duration mismatch, the risk was deposits leaving would leave the bank having to liquidate the bonds at losses and would make the bank insolvent. When SVB recently announced a large loss, depositors started to panic and pull their money.

The FDIC was called in and the bank was quickly declared the bank insolvent. Then the VC sector started to panic. 85% of the deposits at SVB were over $250k and therefore not covered by FDIC insurance. This led to fears of a larger run on regional banks. Major banks are deemed “too big to fail” but regional banks are not given the same luxury. The FDIC then announced that all deposits would be made whole to stop this contagion effect.

All banks borrow short and lend long. However, they all (except for SVB) manage their interest rate risk via derivatives and other risk management tools. SVB weren’t doing anything on the risk management front and as their deposit base was largely institutional, the deposits weren’t covered by FDIC insurance (the insurance covers deposits up to $250k). Hence, the risk of a bank run as all the institutional deposits headed for the exit at the same time. And they couldn’t cover those deposits because all their long dated assets had fallen in value due to higher interest rates.”

As for Credit Suisse, the share price has been telling you that it has been going broke for over a decade.

Source: Google

UBS has potentially got a great deal with the liquidity backstop from the Swiss National Bank and the immunity against litigation.

Despite the similarities with 2008 in the market moves, the drivers are completely different. There is no systematic issue with unjustified lending being amplified by derivative securities. The major economic risk is a contraction in credit leading to a recession, however, one may argue this was already in progress due largely to the interest rate rises we have seen in recent times.

Of course, as we live in the bizarro world (watch Seinfeld for details), weaker economic activity means higher equity markets as markets price in lower interest rates and ignore the potential for lower earnings. The one thing this tells us is resilience in earnings will be the key over 2023 and into 2024.

With that in mind, we did have one disappointing announcement from a company we owned. Rakon (NZX:RAK) put out an update which confirmed this years guidance but indicated that conditions will remain challenging into FY24. The challenge they are facing is in a decline in earnings after a one-off boost from a short-term global chip shortage during the Covid period.

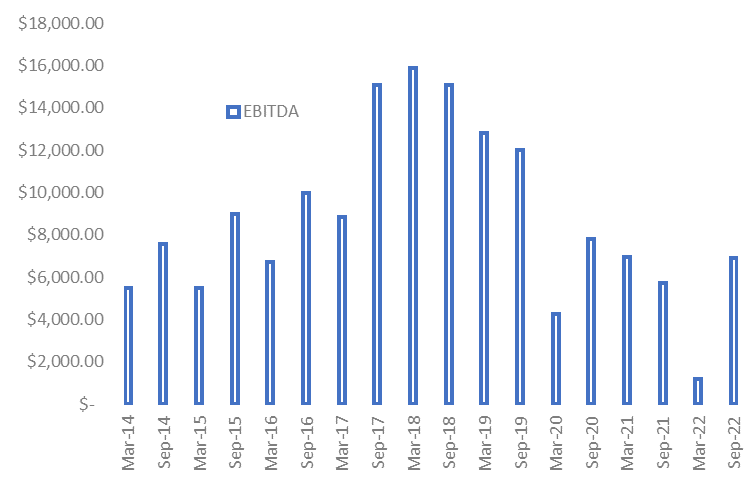

As can be seen below, earnings saw a significant jump in September 2021, which has lasted for 3 consecutive halves.

Source: Company filings, author’s calculations

The challenge in valuing the company is that earnings were always going to come back down. In order to value it, you had to work out what the current steady state earnings are and what the future growth prospects from that base look like. Based on the recent announcements, we believe our estimates of the steady state earnings were too high. We are still interested in the future prospects of the company with the new facility set to open in India and potential consolidation in the fragmented crystal oscillator market, however, at stage we have exited the position (which was small) on the expectations of lower earnings over the next 18 months.

We also trimmed XRF Scientific (ASX:XRF), for different reasons altogether (the cyclicality that we have previously discussed). The proceeds of both went into SRG Global (ASX:SRG), MHM Automation (NZX:MHM), and Gentrack (NZX:GTK).

We have written extensively before on all three, most recently SRG and MHM have been a focus, so in this write-up we will focus on Gentrack.

The last time we wrote about Gentrack was in October 2021:

At the time, we revisited the acquisitive history of the company. This cumulated in the company getting into trouble by buying into the UK market that was facing significant regulatory change. What followed was a period of bankruptcies in their client base which led to losses and eventually a significant write-down of goodwill.

The good news is that the UK drag is almost done and the growth elsewhere is offsetting the remaining decline. We have seen a jump in revenue in the 2nd half of the last financial year.

Source: Company filings, author’s calculations

Leading to a bounce in EBITDA…

Source: Company filings, author’s calculations

And more importantly, Free cashflow…

Source: Company filings, author’s calculations

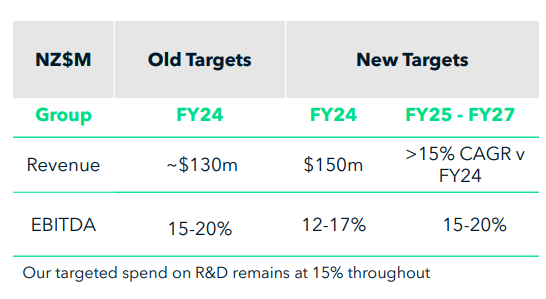

The company has also provided some guidance ranges for the next four years.

Source: Company filings

If these are achieved, the shares are cheap. However, the company has a long way to go to regain trust from the market after the disastrous UK experience. One thing to note, is the change in strategy away from acquisition led growth to organic. The forecasted growth is through geographical expansion, most notably in Asia, where the company already has a profitable office, and in EMEA. The growth seen in the last half and the forecasted growth over the next 12 months helps lock in a higher annual revenue base which will boost the outer years. As we have noticed in the past, the risk is always a fall in project revenue (typically associated with new client wins or upgrades to existing offerings). That part is hard to forecast out more than a year or two, so the FY27 forecast can definitely be taken with a grain of salt.

From our point of view, Gentrack appears to be back in an upgrade cycle and we accumulated a little bit on the market weakness earlier this month.

For those keeping score with regards to the portfolio, it wasn’t a great month, finishing down 1.84% against the All Ordinaries accumulation down 0.17%. Year to date, the portfolio is up 3.48% versus the all ords up 3.61%. So more or less in line year to date (as Buffett says, might as well buy an index fund), but happy that we got a chance to buy a few things at lower prices over the last month.