We mentioned in our monthly write-up that we acquired a new position during the month. That position is a small one in Matrix Composites and Engineering (ASX:MCE). It is a small position because Matrix is a highly cyclical business with lumpy revenue. The company’s main activity is the design and manufacture of Subsea buoyancy modules for offshore oil and gas drilling. Hence, it is very reliant on the oil market and the economics of offshore production.

Matrix listed on the ASX back in November 2009, and the shares went from an IPO price of $1 to a peak of over $9 in early 2011 (as a side note I made money on it back then). The company raised $15m in its IPO to have a market capitalisation of $64m. The use of the funds was to build its new facility at Henderson in Perth. The company was experiencing increasing demand and needed to expand production. As the share price rose the company raised further capital at $2.25 and $8.50. This additional capital reduced the need for debt and brought forward a planned later expansion at Henderson, it also helped alleviate the inevitable cost increases in a build of that nature.

The early boom in the share price was driven by growth in the business, as shown by the red arrow below. Revenue went from $54m in FY09 to $174m in FY11.

Source: Company filings, author’s calculations

Unfortunately, the good times didn’t last. Revenue started to stagnate in the latter half of 2011 and with the larger facility, gross margins fell heavily as the company was running well below capacity. One of the major problems they faced at the time was the high Australian dollar. As the company was competing against players based overseas and all work is priced in US dollars, they had a natural disadvantage as the Australian dollar went above parity with the USD. The result was stagnating / falling revenues and declining gross margins.

Source: Company filings, author’s calculations

The pain didn’t stop in 2011. After initially expecting 20% revenue growth in FY12, the company downgraded and got itself into trouble. The trouble came to light with a trading halt and suspension followed by a capital raising. The order book at this stage had fallen from a peak of $400m to $120m as the company failed to secure work (again, they were fighting the AUD). The lower revenue and the fall in profit meant the company needed to write off some its investment in fixed assets and all this led to it breaching their debt covenants. Ultimately, they had to raise equity once again, this time to pay down debt. They raised $37.6m at $2.25 per share, well below the $8.50 price it had managed before.

Whilst conducting the raising, the company guided to a reversal in fortunes in FY13. However, three subsequent downgrades saw the initial revenue guidance of $225m become $145m and NPAT guidance of $23-25m become a loss of $3m.

The company then seemed to get back on track in FY14 and 15, and for the first time became cashflow positive. Note, the initial cash outflows shortly after listing in the chart below were related to the construction of the Henderson facility.

Source: Company filings, author’s calculations

After a prolonged period of non-existent demand, the last 18 months have seen the first signs of life since the oil price collapse. We can see this most notably in the last six months, with a spike in Revenue and Gross Profit.

Source: Company filings, author’s calculations

They even recorded NPAT of $7.5m for the last six months. The full FY24 NPAT was $3.6m, as the first half was a loss. As revenue is lumpy and order driven, this isn’t going to be a smooth turnaround where every period sees growth, however the signs are clear that demand is increasing. To capitalise on this demand, the company has a world class facility built on the back of the last boom. In the last month, the company has announced a $21m contract win and has announced that they currently have $280m of quotations yet to be awarded including four to six projects with a value of between $80m to $140m. This highlights the lumpiness of the revenue, but also the short-term opportunities available. It is worth highlighting that as revenue grows, so do the margins.

Source: Company filings, author’s calculations

One other area the company is moving into is offshore wind farms with $60m of work currently bid for. Any success here would be a positive as it could help the company derisk away from the oil and gas market.

Source: Company filings

The current market capitalisation is $60m and net cash is $14.4m. On the last reported half, the shares look very cheap, however as we said this isn’t going to be smooth sailing. Due to the lumpiness of revenue, it is dangerous to annualise one half. If we look at the full year for FY24, the shares trade on 16.5x trailing earnings. From their last announcement, the company expects subsea revenue (SURF) to exceed FY24 in the next financial year. They have also pointed to a strengthening market.

Source: Company filings

If the company can convert on the $280m of quotations currently out there, then the next few years could be very lucrative for them.

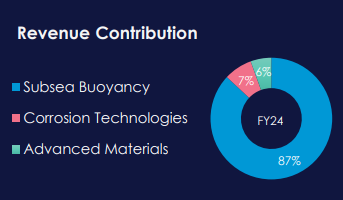

The core of the business is the Subsea buoyancy products, and this will remain so for the foreseeable future. However, they do have a few other smaller revenue sources that are growing.

Source: Company filings

They have guided to recurring revenue from these two divisions of $10m per annum with the possibility of growth. Last year, Advanced Materials revenue grew 80% to $4.7m.

Whilst the growth is impressive, they are small contributors at this stage. We have bought a small position on the expectation that the next few years will see increased Subsea revenues, backed by the current quotation pipeline. The company spent the last boom building its new facilities and as a result have a world class facility. This time with no need to upgrade the cash should flow to the bottom line.

Just a friendly reminder that none of the above is investment advice, it is factual commentary on a portfolio run by the author.

This keeps dropping... market cap of $49m now... A lot of positive signs coming out from the company, just read all their announcements for the last year or so. Things looking up.

Any thoughts on the continued drop?