One of the themes we have missed over the last year or so in the microcap end has been the boom in electrical engineering companies, namely Southern Cross Electrical Engineering (ASX:SXE) and SKS Technologies Group (ASX:SKS). The industry is in a clear upswing, and growing earnings combined with excitement about the growth in the Data Centre industry has driven a bull market. The basic thesis is that these companies are selling the “picks and shovels” for the Artificial Intelligence (AI) Boom. The emerging AI technologies need increased data centre capacity, and these companies are needed to expand that capacity.

Most of the listed electrical engineering companies are experiencing a period of sustained revenue and order book growth. The share prices of the above companies have boomed, SXE up 182% in the last year and SKS up over 1000%. Another company in the sector, Mayfield Group, whilst up strongly over the last year (+86%) has lagged over the longer term and trades at a significant discount to the other two. There are reasons for this, but there is also a potential opportunity in that discount.

Mayfield is a recent backdoor listing, however its history dates back to 1936. The company was acquired by Leighton Contractors in 2002, before being spun out in a management buyout backed by private equity firm, Nightingale Partners, in 2012. The backdoor listing came in 2020, with the company only raising $1.2m in new equity. The vendors of the company received 69.2m shares, the existing owners of the listed shell held 12.2m and 3.3m new shares were issued. This lack of issuance means liquidity is almost non-existent in the stock.

The core business for Mayfield is the supply and installation of electrical switchboards with manufacturing facilities in South Australia and Western Australia (WA was opened in 2018). They also then service these switchboards on an ongoing basis. They also have other subsidiaries focused on the Telecommunications sector and their power needs of those companies, and a power test equipment business which assists businesses in monitoring their power networks.

Post the management buyout, the company got a service agreement to manufacture Schneider equipment in Australia, and then in 2016, they acquired their own IP and developed their own switchboard. Post listing the company has partnered with Magellan to manufacture further products.

The company has clients across many industries, although historically this is skewed to mining.

Source: Company Presentation

Their mining clients have grown strongly in recent times driven by Iron Ore and commodities associated with Electric Vehicles (EVs) such as Lithium.

The company puts a big part of its growth (and of its prospective pipeline) down to the energy transition to more renewables, with growth in the Utilities and Renewables sector. They are also seeing the shift to EVs benefit them through infrastructure work, with large contracts in the rail space. The area which has got the market excited about the sector, data centres, is also an area they are active in, working with NextDC. Recently they have also got accredited by the Department of Defence, that opens a new market to them.

The combined effect of the above is that the work in hand pipeline has grown from $41m to $85m over the last six months. So the outlook is positive and it is worth highlighting there are potentially structural / longer term drivers as well as cyclical ones.

Despite the positive outlook, things are not been so rosy since listing. Revenue for Mayfield has actually fallen over the last two years.

Source: Company filings

The fall in revenue back in FY22 led to two profit warnings. The main culprit was their services division, which saw major cost overruns in one significant installation project and a subsequent fall in work as the company needed to focus on the quality of their revenue. The cost overruns led to a net loss in FY22.

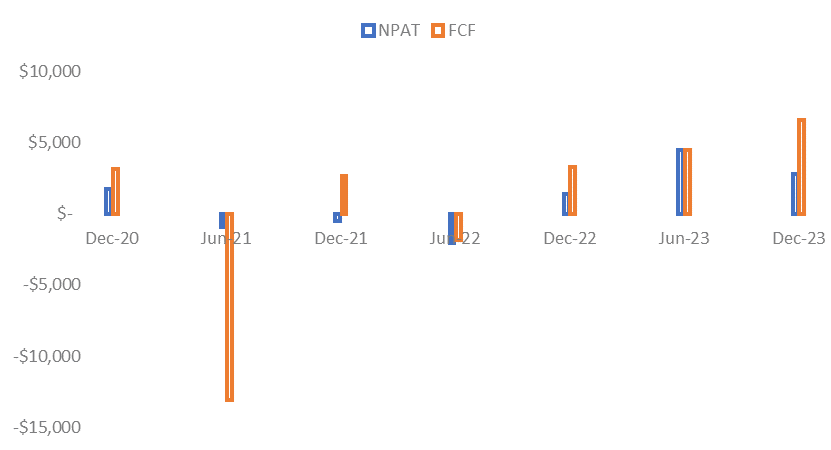

Source: Company filings, author’s calculations

Since then, the company has swung back to profitability and more importantly cashflow has improved significantly. The recent announcement from the company on its dividend highlights this improvement in cashflow.

Source: Company filings

The cash balance has grown considerably whilst paying out dividends. The red bar is the unaudited June 30 number.

Source: Company filings

In total, based on the closing cash balance given, and adding back the dividends paid in the last 12 months, the company has produced over $15m of free cashflow. The current market cap at $0.80 is $73m, and the EV is $57m, putting it on an EV/FCF of less than 4x.

Working capital has potentially boosted this cashflow, we will know more towards the end of August on that front. As a result, we need to take into account profit. NPAT for the first half was $2.8m and doubling that gives a P/E of 13x. It seems likely based on the announcement above that the 2nd half will be stronger than the first.

There is a lot to like about the current position of the company:

Strong cash balance and a low EV;

Improving profitability and strong cashflow conversion;

An order book that has grown from $41m to $85m;

Stronger margins than peers;

A decent dividend yield;

Cyclical / structural tailwinds; and

Significant insider ownership.

Two things are potentially holding the shares back. The issues in FY22 show what can happen to a microcap when one contract goes wrong. Although it is behind them, it does highlight the risk associated with a contractor of this size.

The other issue is more significant and goes back to the structure of the backdoor listing. There is little to no liquidity given the huge insider ownership. No institution can get set without buying off one of the vendors. Even for a private investor, it is hard to get set in any size.

Finally, on the risk side, it is worth highlighting that whilst the “picks and shovels” to the AI sector trade is popular, these companies still tend to make a lot of money from mining and hence we can never forget about the cyclicality.

We have initiated a small position (it is hard to get anything more than that) over the last few days and will hopefully ride the cycle for now.

Just a friendly reminder that none of the above is investment advice, it is factual commentary on a portfolio run by the author.