MHM Automation (MHM.NZ)

It is not often in this part of the world that you come across a company with a history dating back to 1884. Even less frequent is when that company has a market capitalisation less than $50m, which is the case of MHM Automation.

MHM Automation was previously known as Mercer Group. It was founded in 1884 and listed on the New Zealand Stock Exchange in 1959. The core business was the fabrication of Stainless-Steel tanks for the dairy industry. That business still exists today but at its heart, MHM Automation is a very different company.

The evolution of MHM over the last decade is fascinating. The company was on death row after the GFC following some ill-fated acquisitions. In short, debt plus losses is not a good combination. After raising some capital to stay alive in 2011, they welcomed Murray and Co on board in 2013.

2013 also saw a return to profitability. Unfortunately, this didn’t last long as the company fell back into loss making territory a few years later. Murray and Co lost patience and distributed the securities in specie to the investors in their Rakaia Fund. This left Humphrey Rolleston as the biggest shareholder.

Then in 2015/16, the story becomes interesting. A new management team takes over. Non-core divisions and assets were sold. Over that period, they sold their medical division, their interiors division, closed a loss-making Brisbane plant, restructured their fabrication business, downsized the New Plymouth factory and sent machine, design and manufacturing plant to Christchurch where they also relocated their head office to from Auckland.

They also conducted a rights issue which was effectively a 2nd recapitalisation. Rolleston underwrote the rights issue, taking his shareholding up over 50%. With a better balance sheet in place, the company made two key acquisitions: Haden and Custance (H&C) in 2016 and Milmeq in 2018. H&C brought in specialist reverse packaging and product handling systems, most predominately in the cheese industry. Their core product takes bulk cheese and packages it for retail sale. Milmeq brought in automated chilling and freezing systems for meat, poultry and dairy products. The acquisitions were opportunistic and the capital outlay was minimal.

Despite being new acquisitions, Milmeq has been around since 1952 and H&C since 1965.

It is important to note that whilst the acquisitions were opportunistic, they do highlight the new focus of the company: automation. From a boring stainless-steel fabrication company, it had evolved.

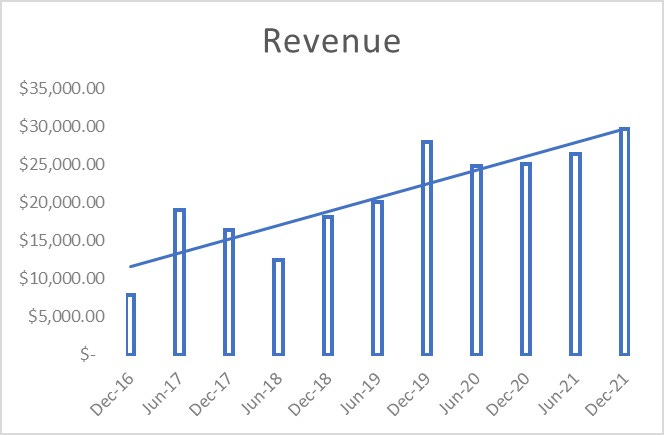

The evolution has brought about significant revenue growth.

Note that the COVID pandemic has impacted revenue as seen in the dip in June 2020. Milmeq products are usually specifically designed and installed for a client. Travel restrictions have impacted these installations. As can be seen below in the breakdown of their revenue which sees Australian and US as key markets.

Despite the lack of travel, Milmeq has been the key driver of growth. This growth has come primarily out of the red meat industry in Australia.

Revenue growth has led to profits. Modest profits were seen from the December 2018 half to the December 2020 half. A step up in profit was seen in June 2021 as their New Plymouth plant was closed and the property sold.

The balance sheet has also improved. Debt is gone and the company is now sitting on cash and paid a dividend last year. At the most recent result, they opted not to pay a dividend as they assess acquisition opportunities.

The transition in recent years has been impressive.

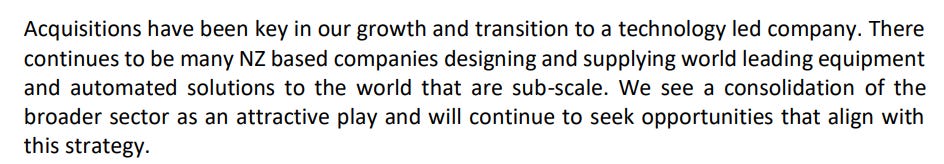

Now the company is profitable and in a net cash position, what does the future hold? Well, automation in the food industry is the focus and acquisitions will be key. There are many sub scale players in New Zealand and MHM can be a consolidator. In effect, the company is set to become a roll-up in the automation industry as can be seen in the quote below from the 2021 annual results announcement.

Going forward, the growth drivers are multiple. Reopening, product development, acquisition and cross selling are all possible. There is a clear focus on margins with a new COO appointed.

The company has a goal of $100m revenue and $10m EBITDA by 2025. Given the new managements track record, there is every possibility of this happening. The current market cap of $45m appears cheap based on that goal.

Current full year guidance is for revenue of $57-60m and EBITDA of $4-4.5m. This suggests the 2nd half is more or less flat on the first half. This would give a NPAT number of $2.8m and put it on around 16x.

Based on today’s earnings the company is not overly cheap. There are risks too. Raw material costs are raising, although the company should be able to pass these on. At the end of the day, the company helps others save cost. Supply chain issues mean delivery times have gone up and revenues can be lumpy (most notably in the Milmeq systems which sell for c. $4m and upwards). The current order book looks strong with plenty of work booked into FY23 but delays run the risk of cancelations. This hasn’t happened thus far but is a possibility.

There is also plenty of execution risk but this is a company that has come a long way in the last few years. Upside can potentially come from a thematic trend towards automation, an industry in food that has seen supply challenges through Covid and the position to be a consolidator in the space.

I’ve taken a small position at this stage and will watch with interest as the acquisition strategy plays out.