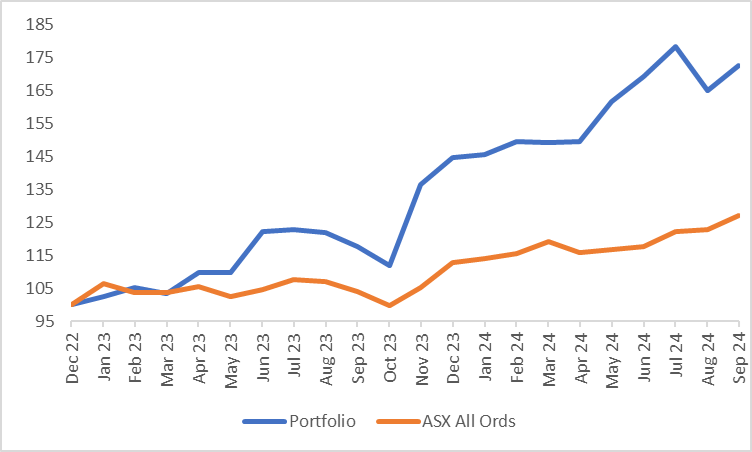

The portfolio rebounded after a poor August, up 4.53% against the All Ordinaries accumulation up 3.45%. Since inception, the portfolio is up 72.4% against the All Ordinaries accumulation at 27.0%.

The top performers were:

Scidev (ASX:SDV), +26.7%;

Environmental Group (ASX:EGL), +12.3%;

Energy One (ASX:EOL), +9.9%; and

Gentrack Group (NZX:GTK), +6.4%.

The top two, Scidev and Environmental Group have a similar theme driving them. Both have parts of their business focused on the cleanup of PFAS chemicals, an area that could provide some blue sky in years to come. For now, though, both are growing albeit at different rates off different bases.

Despite the PFAS connection, the companies are at differing stages. Despite being listed since 2002, Scidev has just turned cashflow positive, after commercialising their products back in 2019 / 2020 and becoming a viable business. We wrote about this when we acquired our position back in May:

Since our purchase, the shares are up 79% and it has grown into our third largest position. The fourth quarter saw a continuation of the trends we had seen previously, and the 2nd half result was strong. Revenue and EBITDA were both up.

Source: Company filings, author’s calculations

Pleasingly the company swung to profitability and on the back of positive cashflow, and as a result the cash burn has ended.

Source: Company filings, author’s calculations

The market quite often gets excited by a company that has just swung to profitability. The expectation of operating leverage kicks in. Scidev’s share price has rallied ahead of the earnings at this stage and the company will need to fill that gap in the coming periods. If we annualise the 2nd half, we get EBTIDA of $11m, placing the shares on approximately 11x that number. If the trajectory continues, that multiple is hardly demanding.

As above, Environmental Group was also up during the month. We wrote about their result in our August writeup:

The result was solid but mixed by division. The Baltec division was the standout seeing revenue up $7m and EBITDA up 205%. Overall, the company has been consistently profitable since new management took over and has grown both organically and via acquisition.

Source: Company filings, author’s calculations

We noted last month that the forward P/E is likely over 20 times and the share price has gone up since then. The share price rally in September was largely driven by a livewire writeup and we are not sure it is 100% supported by the fundamentals at this stage. We reduced our position on the result but continue to hold a reduced position.

The other notable point from the best performing stocks was the movement in Gentrack. During the month the company was added to the ASX 300 and some forced index buying combined with the low liquidity of the stock saw it up further at one stage.

The worst performers for the portfolio were:

Scott Technology (NZX:SCT), -7.3%;

Close the Loop (ASX:CLG), -6.7%; and

EVZ Limited (ASX:EVZ), -5.9%.

The top two have been drags on our portfolio for some time, it seems we have continued to ignore our own advice on the importance of momentum that we wrote about earlier this year:

Scott Technology continues to suffer from the uncertainty around new management with the new CEO starting at the end of August. Their full year results are due this month so that will provide some indication around the operational direction.

Close the Loop has continued to slide post its results, we continue to wait on the debt restructuring which management had alluded to prior to the result and they also reinforced that expectation in August. Over a month later we are still waiting.

During the month we added a new position and it is one that we have owned previously, Austco Healthcare (ASX:AHC).

We sold Austco back after their half year result with concerns around their Free Cash Flow, we wrote about this here:

John Maynard Keynes is often quoted as saying “When the facts change, I change my mind.” Apparently, this is a misquote and he actually said “When my Information changes, I alter my conclusions.” With investing, it is important to not be wedded to the past or previous views, you have to adapt to the information available.

With that in mind, we reviewed the full year result for Austco and saw several of our concerns disappear. The full impact of the recent acquisitions saw profit and free cash flow jump.

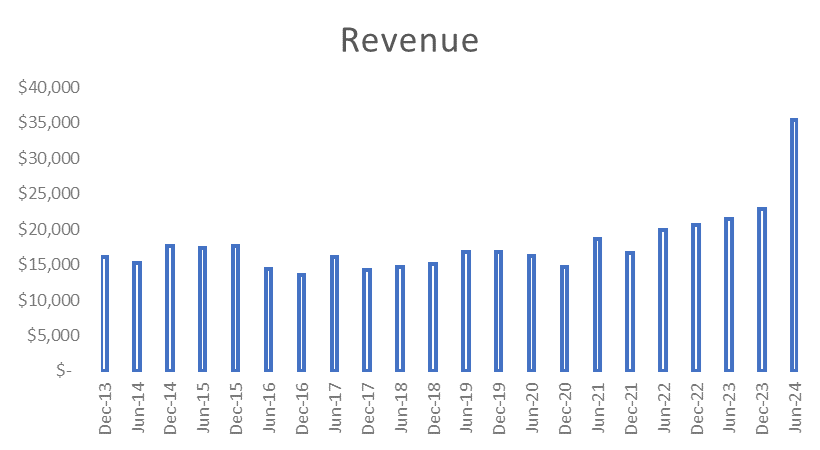

Source: Company filings, author’s calculations

The profit growth was driven by revenue growth. Revenue was up 39% or $16.2m. $7m came from the existing business (i.e. organic), whilst the remainder came from two acquisitions settled during the year. The full year impact of those two acquisitions will drive revenue higher again next year.

Source: Company filings, author’s calculations

The 2nd half jump in revenue was clearly driven by the acquisitions, and those acquisitions have provided this business with a critical mass. It is also easier to value. If we look at the 2nd half, EBITDA was $8.1m and Profit before tax was $4.8m. NPAT was higher as the company realised some tax losses that it will be able to utilise in coming periods. If we annualise the Profit before tax and take off a 30% tax rate then we are looking at normalised NPAT of $6.7m. This could be higher on a runrate basis as the full year only included 3 months on the Amentco acquisition.

The market cap currently stands at $94m placing it on a multiple of 14x. When we purchased the shares earlier in the month, the market cap was around $80m. We got lucky with our timing as the retired founder of the business sold out shortly after our purchase and removed an overhang.

Whilst we have bought back in and believe the shares to be good value, there are a few things to be aware of. The company has a high cash balance, which is great, however a number of commentators use this to value it on an Enterprise Value (EV) basis. A large part of this cash balance will be utilised to pay earnout payments on the recent acquisitions. In valuing the company, I choose to ignore it.

Secondly, the software side is still a disappointment. Software revenue came in at $9.3m for the full year, up from $8.5m last year. Meanwhile, the company is capitalising $2.3m in Research & Development. This rate of capitalisation doesn’t make the investment case for the software component at this stage. When I first purchased the shares, the hope was the recurring and higher quality software revenue would become a meaningful part of the business, however this is still not the case.

Source: Company filings, author’s calculations

Despite the lack of meaningful growth in the software division, the acquisitions appear to have really added value and we are happy to be investors once again.

We trimmed some Gentrack and sold out of our remaining Integrated Research in order to fund the new position.

Just a friendly reminder that none of the above is investment advice, it is factual commentary on a portfolio run by the author.

I sold on the EGL result as well. Baltec was the shining light, but the rest of the divisions were pretty soft in terms of revenue growth. I've had a look at SciDev before but didn't like management and lack of management/board ownership. I think EGL is a much higher quality company in these respects. Also, EGL have some world leading products (Baltec) and seem to have a great culture of innovation.