Following the takeover for MHM Automation, the portfolio is set to have a significant level of cash. To that end, we have been searching for places to deploy it. It is important in investing, that in good times, you don’t get overconfident. We are in no rush to deploy the capital, but it is a good time to dust off the thesis on a few different ideas.

Starting with some stocks we have owned for a while. We have been buying SRG Global (ASX:SRG) and Close the Loop (ASX:CLG) in recent months.

SRG Global recently hit a low of 60 cents, after having traded as high as 82.5 cents earlier this year. The company announced solid results in August, and has grown in recent years both organically and via acquisition. The slight disappointment in the result was the guidance indicating a slow down in organic growth. We covered the result back in our August update:

https://taurangainvestments.substack.com/p/august-update-part-1

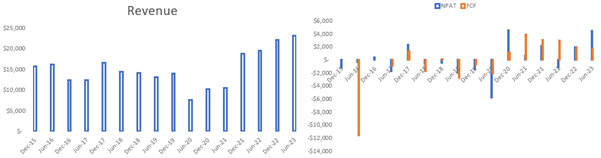

Since the result, the shares have continued to trade down, although they have started to get support in the last few weeks. At 65 cents per share, they still trade below 10 x last year’s NPATA with, based on our estimates, 7.5% organic growth guidance for the next year. The company continues to win work and grow their record pipeline. From the charts below we can that the company has consistently grown following the setback associated with the Global Construction Services merger.

Source: Company Filings, Author’s Calculations

Over the last three years, the company has generated $89m of FCF, equivalent to 25% of the market cap. That includes an outflow of $15m due to working capital increases in the last half (which should reverse). Factoring in their 20% EBITDA growth, the shares likely trade on sub 9x NPATA on a forward basis. Unless something goes wrong with their pricing, it is hard to see them trade lower in the short term. It is worth highlighting that this is a low margin contractor business, so the shares will never trade at a high multiple, but a rerate to 11 or 12x combined with a solid dividend yield could see a solid return over the next year.

Close the Loop has seen a similar trading pattern to SRG, selling down since it’s result in August, before a bounce in the last few weeks. The selloff in Close the Loop, has been more extreme. The shares fell from 50 cents back in July, to 27c recently, a fall of 46%, despite little change in the outlook.

One thing of interest with Close the Loop, is that along with the undemanding multiple, the company has overcapitalised on the last raising and has capacity for further acquisitions. It essentially is a rollup play in the “circular economy”, which is a fancy name for complex recycling. An acquisition would hopefully boost earnings expectations.

SRG and Close the Loop have become our two largest positions, outside of MHM, which we are holding for the cash at this stage.

Outside of the stocks we already own, a number have come on our radar in recent times. These are Environmental Group (ASX:EGL), Dropsuite (ASX:DSE) and Smart Parking (ASX:SPZ).

Environmental Group is similar to Close the Loop, in that it is a rollup with some exposure to the Circular Economy and recycling. Environmental Group is a bit more diverse and fragmented than Close the Loop with business units focused on several environmental areas including Air Quality, Water Quality, renewables, as well as the energy division focused on boilers and gas fired equipment.

The company was incorporated in 1923 and listed on the ASX since 1977. Despite that history, in recent years, the company has been barely profitable. So why invest in it? Things have taken a turn post Covid, mainly due to the acquisition of Active Environmental Solutions, which came with the appointment of a new CEO, Jason Dixon (the vendor of that business). Jason comes to Environmental Group after having spent a decade at Tox Free Solutions. During that time, Tox Free completed $400m of acquisitions and raised over $200m of capital, and was eventually sold to Cleanaway for $831m.

Tox Free provides the blueprint for the future of EGL, acquisitions, capital raising and hopefully success. Having been in place for two years, the initial signs are good. Revenue and Gross Profit are both up.

Source: Company Filings, Author’s Calculations

Cashflow is starting to come through, and the balance sheet has a little bit of cash following a capital raising.

Source: Company Filings, Author’s Calculations

The outlook is positive as well, with guidance of EBITDA growth greater than 30% in FY24. Part of that growth is driven by the acquisition of Airtight in April 2023.

Overall, the situation does remind us a little of MHM. A company with a long history that was going nowhere, appoints a new management team and then starts a rollup strategy in an attractive industry. Similar to MHM, we have started with a small position and will increase that if management continues to execute. If you are interested in a more detailed write-up, Harley Grosser did an excellent one on Livewire.

Dropsuite is a high growth company that has recently become profitable. Founded in 2011 and listed on the ASX in 2016, the company provides back up services for websites and email.

After a slow start, and a setback in 2019 when the company lost two clients, things have started to improve. The company has grown revenue and become profitable.

Source: Company Filings, Author’s Calculations

The focus going forward is growing their customer base of managed service providers (MSP), where they estimate they have 3% of the global market. Through accessing the MSP market, they get access to the end users. The result is a lot of customers at a low average revenue.

Source: Company Filings

At this stage, it is not one for us. The growth is great, but the shares trade on 91 times the trailing 12 months.

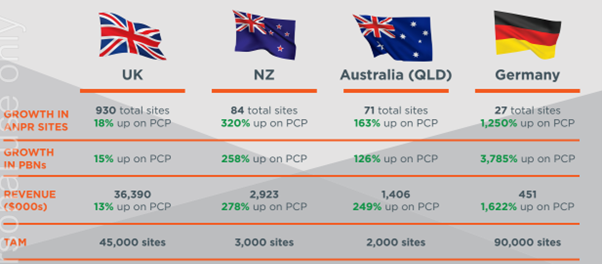

The final company we have been looking at is Smart Parking (ASX:SPZ). Smart Parking is a technology company focused on parking management. The company has been successful in the UK, and is now expanding in Australia, New Zealand and Germany.

Revenue has bounced since Covid and the company is profitable and cashflow positive.

Source: Company Filings, Author’s Calculations

Most of the revenue and all the profit comes from the UK. However, the upside potential of Germany is interesting.

Source: Company Filings

The shares currently trade on 19x last years earnings, and they have guided for c. 34% growth in sites over the next two years. However, when looking at the valuation, you have to strip out the impact of a one-off tax benefit last year which arose from the realisation of previous tax losses. If we take a more “normal” tax rate of 30%, the multiple is actually 27x. In doing that, we also have to acknowledge the cashflow will exceed profit in the upcoming periods of the benefit of the tax losses comes through.

If the company can repeat its success from the UK in Germany, then the addressable market will be more than enough to justify the price. However, there may be some time before the profitability kicks in. At this stage, we haven’t taken a position but it is one on the watchlist.

Just a friendly reminder that none of the above is investment advice, it is factual commentary on a portfolio run by the author.