April was a wash for the portfolio, up marginally (+0.11%), against the All Ords Accumulation down 2.70%. Since Inception, the portfolio is up 49.5% against the market up 15.9%.

Gains in Integrated Research (+11.0%), Close the Loop (+6.8%) and SRG Limited (+5.0%) were offset by falls in EVZ Limited (-12.5%), Scott Technology (-8.6%), and Gentrack (-8.0%). The main news flow came from two of those falling stocks: Scott Technology and EVZ Limited.

Scott Technology

Scott Technology announced their first half result for 2024 during the month. The headline revenue and EBITDA numbers had been preannounced in the wake of the CEO and CFO leaving, we wrote about that last month:

March 2024 Update

Our portfolio fell 0.03% in March against a market that rose 3.11%. Since inception our portfolio is up 49.3% against the All Ords Accumulation up 19.1%. The main drag on the portfolio was Close the Loop Group (ASX:CLG) which fell 21.3% in March. We bought some more Close the Loop and it is now our largest position, as stated last month we were surprised…

Those headline numbers were positive; however, the full detail of the results provided more of a mixed bag. EBITDA grew 17%, however underlying earnings per share fell 13% primarily on the back of increased lease liabilities. Reported profit fell by more than that as the company threw away $2.4m on a strategic review that went nowhere.

The lease liabilities, whilst dragging down NPAT, could be part of a long term positive as the company is moving into larger premises for Rocklabs in Auckland and for the Materials Handlings division in the Czech Republic. These two divisions were the key driver of revenue and EBITDA growth.

Source: Company filings

Materials Handlings and Logistics (MHL) grew revenue by 35% and Rocklabs grew revenue at 53%. The growth in premises and the forward work locked in suggests these businesses will remain buoyant. The main disappointment was the Protein division where revenue and segment profit fell.

Source: Company filings

At the full year result, you had three divisions all growing, now you have two out of the three. The overall result is solid at the top line with Revenue and EBITDA looking healthy.

Source: Company filings

However, at the bottom line, it doesn’t look as healthy. In addition, cash flow was very weak for the half.

Source: Company filings, author’s calculation

The cashflow for this business can be lumpy and several large projects in progress will be completed later in the year and that should see the large outflow reversed.

Based on the trailing 12-month period, the shares now trade on 13.5x underlying NPAT (that ignores the wasted strategic review). However, uncertainty has increased and it is a tough to get a reading on the business as a whole given differing fortunes across divisions. With the CEO and CFO leaving (the CEO has agreed to stay on for a little longer to smooth the transition), it therefore makes it quite hard to get too bullish on the shares. Having said that there are clear positive signs for MHL in Europe, and for Rocklabs closer to home. The bulk of the order book sits within MHL with significant contracts with large name companies.

Source: Company filings

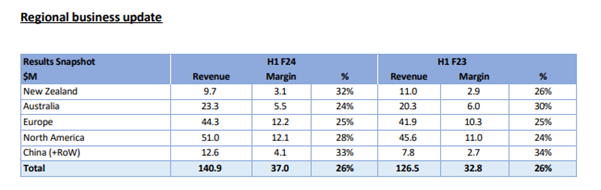

Whilst on Scott, it is worth highlighting their geographical diversity. It is a New Zealand company, but the bulk of the revenue comes from Europe and the US.

Source: Company filings

It is important to note this given the slowdown in the New Zealand economy. We are currently in a mild recession and in recent days, downgrades at Tourism Holdings (THL.NZ) and Spark New Zealand (SPK.NZ) have indicated that conditions are getting worse.

Tourism Holdings has downgraded their FY24 guidance on the back of lower ex-fleet vehicle sales in both Australia and New Zealand. This is consistent with the picture we are seeing from the consumer in both countries.

Source: THL company filings

Further to this, Spark New Zealand downgraded earnings on lower demand for IT services. Government cuts have by all accounts been brutal, and this will flow through to those companies exposed.

Source: SPK company filings

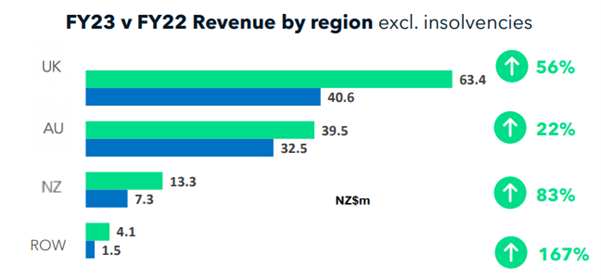

The only two NZ listed companies we currently own are Scott Technology and Gentrack (GTK.NZ). As shown above, Scott makes a majority of its money offshore as does Gentrack, we can see this through their largest division (the Utilities division).

Source: GTK company filings

The reliance within Gentrack is within the UK and Australia, combined with a clear growth strategy in Southeast Asia and the Middle East. In addition, Utilities are a non-cyclical sector with spending in those companies less impacted by the economic cycle.

The reason for pointing this out is that we have very little exposure to the New Zealand economy at this time, and based on the current data we are not inclined to rush out and get some.

We do have some exposure to the Australian economy, more through the capital cycle than the consumer, in holdings of SRG Limited, Environmental Group, and EVZ Limited. The latter of which put out their quarterly cashflows last month.

EVZ Limited

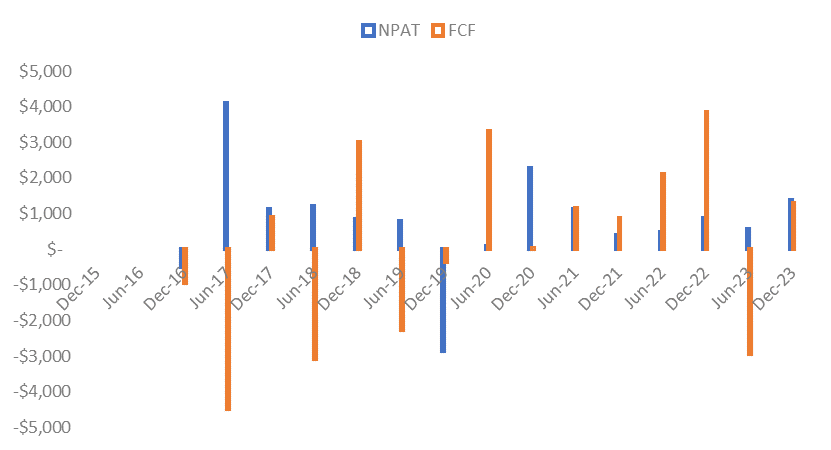

At a headline level, the cashflow from EVZ over the March quarter was a shocker. The company burnt through over $3m from their cash pile at the operational level and spent another $800k on capital expenditure. Cash on hand fell from $10.4m to $6.5m, which in turn increases the Enterprise Value and makes the valuation less attractive.

Despite the fall in cash, there were two positives in the quarterly. Firstly, the operating cashflow decline should reverse in the near future as major projects are set to be completed in the first quarter of FY25. In particular, the largest current project, the Viva Energy Strategic Storage project, is set to complete in July 2025. Based on those expectations, we could see another cash outflow in the next quarter, followed by a significant cash inflow in the September quarter. As can be seen below, the cashflow of this business can be volatile. This is due to the nature of the contracts they sign and the small size of the business. Larger contractors have more diversification and cashflows tend to be smoother.

The other positive in the quarterly, was the contracted work increased from $65m to $70m since the half year result, so the company continues to win work and grow the pipeline.

Overall, despite the cash burn, we are happy to hold a small position here on the expectation it will reverse and the fact the order book continues to grow. At a market cap of $18.8m and a EV of $12.3m, we are not paying much for it.

Just a friendly reminder that none of the above is investment advice, it is factual commentary on a portfolio run by the author.