The post below contains mentions of Scott Technology (NZX:SCT), SRG Global (ASX:SRG), Close the Loop (ASX:CLG) and Clover Corporation (ASX:CLV).

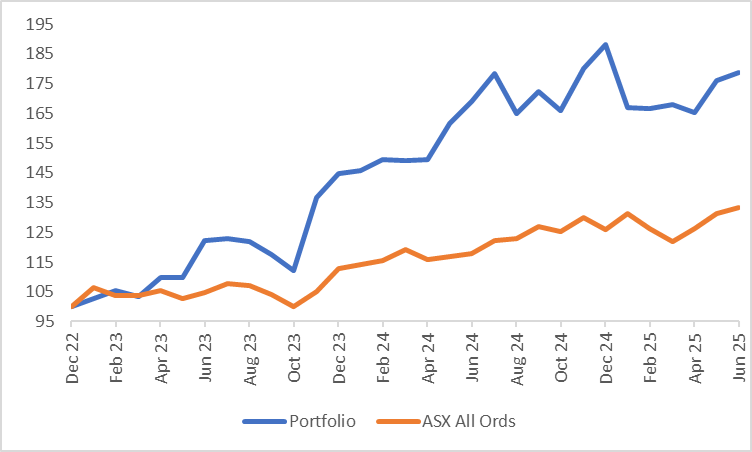

The portfolio was up 1.49% for the month of June, basically in line with the market as the All Ordinaries Accumulation rose 1.44%. Since inception the portfolio is up 78.6% against the All Ordinaries Accumulation up 33.3%.

The positive return this month was helped by two positions:

Scott Technology (NZX:SCT), +15.7%; and

SRG Global (ASX:SRG), +14.6%.

Scott Technology rose on the back on a trading update that signaled a turnaround from their weak first half. After revenue fell 14% and EBITDA fell 27% in the first half, an operational improvement has seen the year-to-date numbers move to a revenue fall of 7% and EBITDA actually being ahead of the prior year. The red bars below show what the result would be if that result was extrapolated through to the full period with two months to go.

Source: Company filings, author’s calculations

From the above, we can see the key driver of the improved EBITDA is cost cutting with revenue not quite back to the recent highs. The new management team appears to be making some early operational improvements. Of course, what really matters is cashflow and we don’t have any insight into this for the second half. Free cashflow for Scott is lumpy and revolves around large automation projects. The company has realised a lot of cash over the previous 12 months despite falling earnings as projects come to a conclusion and payments are made. This may reverse given the new contract wins in both the manufacturing and food space.

Source: Company filings, author’s calculations

Given the volatility in Free Cash Flow, it is hard to value the shares currently, but the positive momentum seen in the second half is the best news for some time. The improvement in EBITDA should flow through to NPAT and the current trailing multiple of 21x is likely to be irrelevant. It is currently a small position in the portfolio, and whilst the bounce in the share price from the recent lows is nice, it doesn’t move the needle a great deal in the overall scheme.

Where we did see a decent return for the portfolio last month is from our 2nd largest position, SRG Global. The shares rose 14.6% over June, bringing the return over the last two months to 33.7%. When we look at the last two and a half years of running this portfolio, our positive returns have largely come from four positions – MHM Automation, Gentrack Group, Energy One and of course, SRG Global. On the flipside, our losses have almost solely been driven by Close the Loop (ASX:CLG). Outside of those five positions, we have been active and made small gains from positions such as Austco Healthcare, Environmental Group and Mayfield Group Holdings, whilst losing small on things like Vitura Health and Aroa Biosurgery.

From the distribution of our gains and losses, it is clear that we need to focus on getting the big things right. So, with that in mind, I want to compare one that went right (SRG Global) with one that didn’t (Close the Loop). This comparison has been partly inspired by an online comment from one of New Zealand’s best performing fund managers in recent times.

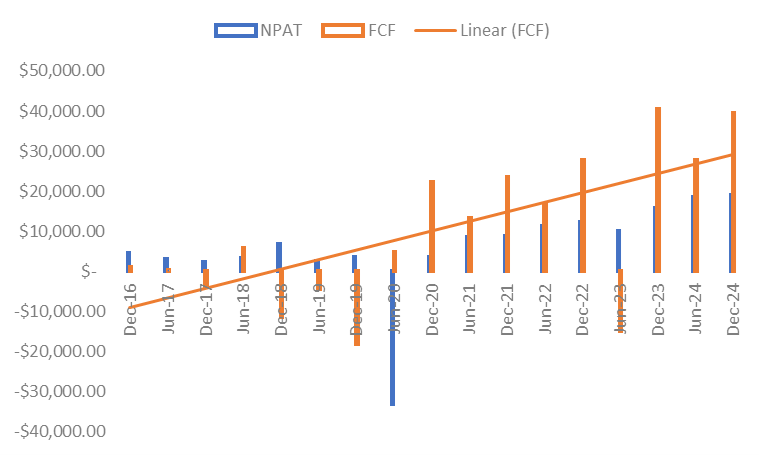

It is in that simple comparison of accounting earnings to cashflow that we can see the dichotomy between the two investments.

We first wrote about SRG Global in early 2023:

The basis for our investment decision was all around Free Cash Flow:

“The investment thesis at its core is very simple. In the previous 2 years, the company had generated $75.9m in free cashflow, equivalent to 22% of its market capitalisation currently. After a very strong first half result just announced, it has now generated $103.7m over 2.5 years, equivalent to 31% of the market capitalisation.”

Fast forward to now, and that trend has continued.

Source: Company filings, author’s calculations

The company has utilised that Free Cash Flow and made acquisitions with it. Those acquisitions have further boosted Free Cash Flow. Impressively, every time the company utilises its balance sheet to buy something, it quickly flips back to net cash

.Source: Company filings, author’s calculations

We wrote about the latest acquisition last year:

In making these acquisitions, SRG has become a higher quality company with recurring revenue now making up 80% of its total revenue (although we note all recurring revenue is not created equal). The market has rewarded the company, and we have seen a significant rerate in the multiple along with the increase in earnings.

Of course, the term “Quality” is relative. The best way to describe SRG is as a quality company in an average industry. It’s margins and returns on capital are low, however they are consistent, and the company has grown its scale. When we first purchased the shares, they were trading on sub 10x with a dividend yield of over 5%. Based on the free cash flow consistency, we believed a rerating was possible. That has now occurred and has potentially overshot the other way.

Source: Company filings, author’s calculations

On the other side of this equation was Close the Loop (ASX:CLG). We started buying Close the Loop in May 2023 after the acquisition of ISP Tek Services. The rollup of packaging businesses that had floated on the ASX was in decline; however, we felt the prospects of the newly acquired electronics refurbishing business were positive.

We revisited our position in May 2024:

At the time we identified some risks:

“The main negatives we have noted above are the lack of track record, the decline from the plastics division and the proof of cash conversion.”

It is that proof of cash conversion that came back to bite us. In fact, after the subsequent result we wrote a post entitled “Where’s the cash?”:

We saw in that result a great example of the conflict between cash and accounting. Headline accounting numbers were positive (EBITDA up 85%), however cashflow was weak and net debt unexpectedly rose. Frustratingly, we identified the red flag and failed to do anything with it.

Ultimately, management drove the refurbishment business off the cliff much like they did with the packaging business. We were given a 2nd chance to exit when Private Equity came for a look, however once again we didn’t take that. Thankfully we did sell after the first official downgrade in January and haven’t been there for the market (rightfully) questioning its status as a going concern. The shares are now languishing around 3 cents.

The key lesson being when you have to ask, “Where’s the cash?”, it’s probably time to move on.

Finally, we added a small position during the month. This is in Clover Corporation (ASX:CLV). Clover Corporation has been listed on the ASX since 1999 and is a producer of dry powder DHA (Docosahexaenoic acid) products. These products are used to add Omega 3 to various nutritional products, most notably baby formula. Essentially what they are adding is a dry powder form of fish oil. The use of powder as opposed to the oil is beneficial to the taste of the product it is added to. Babies are apparently not fans of fish oil. DHA is added to baby formula as it is beneficial for brain development and the addition in some cases has been mandated by governments.

The company has been profitable for well over a decade, albeit in a cyclical nature. The most notable boom being the Chinese led Covid buying one in 2020. That boom saw the shares hit a level above $3 (currently $0.515).

Source: Company filings, author’s calculations

Since then, demand has been inconsistent. During June, the company put out guidance pointing to a strong second half of the financial year with an increase in revenue and profit (the guidance is shown in the red bars above). The guidance puts the shares on a P/E approximately 12x.

Despite the inconsistency in demand, it is worth highlighting that the revenue base now sits about twice where it was 10 years ago. In addition, after building it’s supply base, the company is now back in a net cash position.

Source: Company filings, author’s calculations

And that consistent supply has meant that its gross margins are stable.

Source: Company filings, author’s calculations

One of the potential negatives from a long-term perspective comes down to the use of Fish in production as opposed to Algae. Some of the larger producers globally are leading a shift to Algae as it provides greater sustainability. In the short term however, the cost of production for the Algae product appears higher than that of the fish products, giving Clover a slight economic advantage.

Aside from the recent guidance, there is no compelling reason to rush out and buy the shares. As we have seen in the past, this company has had other unsuccessful starts followed by cyclical downturns on the back of destocking. This time around it may be no different but with solid balance sheet, a regular dividend and a strong second half on the way, we are happy to take a small watching / research position. Ultimately when you look back at the last 20 odd years, this company has been a success story and whilst not the most exciting one out there, it probably still has some good years ahead of it.

Just a friendly reminder that none of the above is investment advice, it is factual commentary on a portfolio run by the author.

Also if you have time and inclination check out AVG. Interesting upside potential here next year

MCE starting to re-rate towards 50c now on a potential AIS takeover. Any thoughts? I know you sold out (bad luck on timing but can’t win ‘em all) but keeping an eye?

I have a 2% of portfolio position so not huge for me.

cLG still hurts me as well . Lost 10% of portfolio. I don’t think I learned anything