Note that this post is too long for some email providers, please click through to read the entire post.

The portfolio was up 8.16% for May against the All Ordinaries Accumulation up 0.87%. Since inception, the portfolio is 61.7% against the All Ords up 16.9%.

The portfolio return was driven largely by two positions:

Integrated Research (IRI.AX), up 65.1%; and

Gentrack Group (GTK.NZ), up 17.8%.

We also added a new position during the month in Scidev (SDV.AX).

Integrated Research

Integrated Research provided an update ahead of their financial results that are due in August. After a period of cost cutting, which moved the company back into a cashflow positive position, we are now starting to see topline growth. The below table shows the guidance for this year relative to the prior year.

Source: Company filings

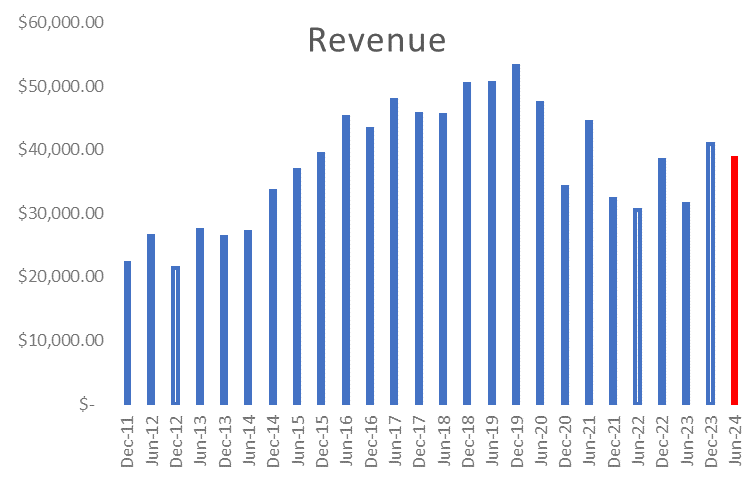

The mid-point of guidance for revenue implies 23% growth in the 2nd half on the prior corresponding period. This is indicated by the red bar below.

Source: Company filings, author’s calculations

We only bought Integrated Research recently. We do so after they announced their half year result in February. The rational behind that purchase can be found here:

Allocating Capital Part 2

As mentioned in our February update, we added two new positions in February. These were in: Integrated Research (ASX:IRI); and EVZ Limited (ASX:EVZ). Both positions are small and definitely fall into the “value” category. Despite that similarity, the two companies operate in very different industries. Integrated Research is a software company that has prod…

At the time we noted the cost cutting was the primary reason behind the return to positive cashflow. We also indicated that we weren’t expecting much topline growth, in particular from the Collaborate product. That made the highlighted part below surprising.

Source: Company filings

When we bought the shares, we noted that the Enterprise Value was approximately 3x Free Cash Flow, after the rally last month the Enterprise value has increased to just over $100m (taking the December 31st cash balance of $21.5m). Using the midpoint of the company’s guidance, this still places it on less than 5x EV/EBITDA. Given recent changes in the company’s accounting policy (this is covered in the link above), the EBITDA is a lot cleaner than it used to be with no capitalisation of software development. This means we can estimate FCF with EBITDA less 30% tax and a small amount of capex. In doing this, its puts it on a very rough estimate EV/FCF ratio of somewhere between 6.5-7x.

The valuation is still not demanding, and if the revenue growth can continue, a further rerating could be in play. However, it is still too early to make a judgement of the sustainability of this growth, particularly in the Collaborate product, hence why the valuation remains low. We continue to hold after these positive signs.

Gentrack Group

Gentrack reported their first half result for FY24 during the month and it included an upgrade to their full year guidance. The guidance upgrade was primarily around increased revenue, which is now expected at c. $200m versus previous guidance of greater than $170m. This is on the back of the first half result which saw revenue increase 21% or $17.7m despite losing $19.7m from insolvent UK customers.

Source: Company filings

We have written extensively about the issues in the UK previously here:

Gentrack – Checking in on the turnaround

I first invested in Gentrack (GTK on the ASX and NZX) back in 2015. The company listed in 2014 and then proceeded to commit the cardinal sin of downgrading just barely 6 weeks after listing. This led to the stock price spending almost two years in purgatory as the company had to regain the trust of the market.

The good news is that the insolvency issues are now fully behind the company, the revenues from insolvent companies in the UK have been completely worked through and this result was the first one without any impact. The drag on growth is now gone.

The tailwinds for the company are multiple. Firstly, the company is expanding into new markets, primarily Southeast Asia and the Middle East. After being impacted by Covid, the Airport divisions is returned to growth and is back to being commercially viable. Finally, the G2 offering which integrates the Gentrack products with the Salesforce CRM is set to be a market leader and underpin growth over the coming years.

The outlook is very positive; however, the valuation is very extended. The company, despite the revenue growth, is still barely profitable. The midpoint of their EBITDA guidance was upgraded from $23m to $25m and NPAT for the half came in at $4.3m. Given that the 2nd half guidance is basically flat on the first half (up significantly from the pcp), we are looking at P/E multiple of over 100x.

Source: Company filings, author’s calculations

Part of the reason for the lack of profitability has been the decline of the UK business, however that is over now. The other reason is the increase in Research and Development focused around G2. A reminder that Gentrack over the years has gone from fully expensing R&D to capitalising some and then back to fully expensing.

Operating leverage should kick in in the coming years. The company previously has stated medium term EBITDA targets of 15-20%. Similar to Integrated Research, a majority of EBITDA should flow through to Free Cash Flow, given low capex requirements. In order to justify the current c. $1bn market cap, those margins need to be realised soon.

Scidev

As mentioned above, we initiated a small position in Scidev (SDV.AX). Scidev is essentially a water treatment company. Their solutions are twofold:

The treatment of PFAS (per- and poly-fluorinated alkyl substances). These are harmful chemicals used in the manufacturing of certain goods over several decades.

Chemical treatments that reduce freshwater consumption from Mining companies.

The company listed as Indec back in 2002. They then acquired 50% of Science Developments in 2014 and the remaining 50% in 2017. It was really a concept company until 2019/2020 when it started to make real revenue on the back of commercialising the Science Development products, as well as some bolt on acquisitions.

Source: Company filings

Revenue has grown quickly, however costs have too, and the company is yet to become consistently profitable.

Source: Company filings, author’s calculations

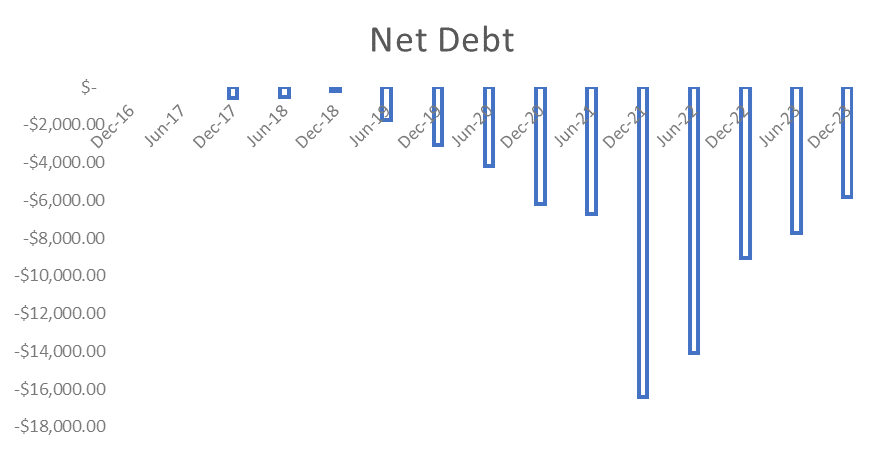

On the back of the revenue growth, the company has raised equity and has been burning through that in development costs.

Source: Company filings, author’s calculations

The company needs to reverse this trend soon in order to prove the viability of its business model. The Q3 update went some way towards doing this with revenue up 38% on the pcp, and operating cashflow and EBITDA both in positive territory. The trend on the net debt chart above has also reversed with cash rising over the quarter.\

Source: Company filings

We have a small position here for now. The company makes the bulk of its revenue through its Chemical division, however it is the water technologies business that potentially provides significant upside. This upside comes about due to the global shift away from using PFAS in manufacturing and the need to clean up years of use. A simple google search shows how significant this issue is and Scidev could be a beneficiary.

Hotcopper

I noticed some traffic coming across from Hotcopper during the month, thank you for the mention and thank you to those who have come across and signed up. There were a few questions that arose on the Close the Loop thread. I want to assure all readers that I had nothing to do with the rise in the share price that day. I was sitting on that article and decided to rush it out that day after the share price move, it was already at 35.5c when I got it out. My following is not large, and the amount of money I am running in this microcap strategy is embarrassingly small, I doubt I can have that impact.

What can have an impact though is flows. The microcap market in general was buoyant this month, of the seven stocks that we held at the start of the month, only one finished the month in negative territory. That company was Scott Technologies, which continued to fall after their results and the departure of the CEO and CFO. We wrote about this last month:

April 2024 Update

April was a wash for the portfolio, up marginally (+0.11%), against the All Ords Accumulation down 2.70%. Since Inception, the portfolio is up 49.5% against the market up 15.9%. Gains in Integrated Research (+11.0%), Close the Loop (+6.8%) and SRG Limited (+5.0%) were offset by falls in EVZ Limited (-12.5%), Scott Technology (-8.6%), and Gentrack (-8.0%)…

Back to the subject of flows and part of the reason for the microcap rally could be the below.

Source: Company filings

$90m is a lot of money to put to work in low volume stocks and deploying it comes with challenges. Aside from the stocks we hold, we did note movements right across the microcap space during the month with a number breaking out of recent trading ranges.

Finally, for the new subscribers, here is a little bit of background reading about what I am doing on this blog. Firstly, here is the rationale behind why I write:

2023: Writing More

I setup this blog a few years ago with the idea of writing regularly. Unfortunately, life, as it often does, got in the way. Over the last four years, I have moved country, started a new job focused more on the Macro side of investing and have bought a house. This combined with what I considered irrational markets meant that overall, I had little time t…

And secondly, at the bottom of this post there is some portfolio context:

August Update Part 2

Austco Healthcare (ASX:AHC) On the surface of it, the Austco Healthcare result was ordinary. However, when we look at how the company is setup, we see some really positive signs for the next few years.Thanks for reading Tauranga Investments! Subscribe for free to receive new posts and support my work.

Please note the portfolio in that post is not current, also please note it is highly concentrated microcap portfolio with the goal to generate alpha with little to no consideration of portfolio theory. Please do not try this at home and never act on my actions written here.

Just a friendly reminder that none of the above is investment advice, it is factual commentary on a portfolio run by the author.

Great work Guy

Just take the wins when you get them in a modest humble way of course : )